By Boyce Thompson

How to get a construction loan

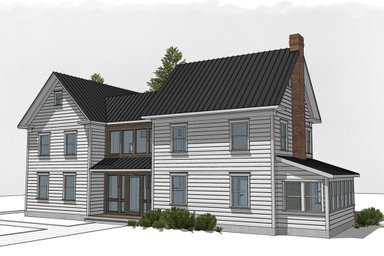

Image © Vitalii Vodolazskyi - stock.adobe.com

You found the perfect house plan (or you're narrowing the search), and now it’s time to start planning for construction. For most people that means securing a construction loan. It’s not as easy to do as it was before the housing bust – there’s more paperwork involved, and lenders want a bigger down payment. But if you have your financial house in order you should be able to get it done.

The first step – besides making sure your credit score is up to snuff – is to meet with a couple lenders to determine your borrowing capacity. Not all lenders make construction loans to home owners. The most likely candidates are regional or local banks or credit unions who do a lot of real estate business. Their first concern will be that you can carry both a mortgage on your existing home – until you sell it – and a loan to finance the construction of your new home.

There are two basic types of construction financing – one-step or two-step. In the two-step process, you get a construction loan to build the house then apply for a “take-out” mortgage once it’s complete. That gives you time to shop your mortgage loan and maybe get a better rate. This option also provides the freedom to change your mind about design during construction.

But most people go for a “one-step” loan, simultaneously securing a construction loan and long-term mortgage. Doing this in one transaction saves $2,000 to $3,000 in closing costs. You pay interest – typically one percent above prime – on the construction loan. Then when your house is done, the loan rolls over into a mortgage, which can be either fixed or adjustable.

Lenders are looking for a down payment of 20 to 25 percent on these loans, depending on the size of the project, your credit rating, and whether you are financing a lot purchase as well. If you already own a lot, you may be able to use it as equity for the construction loan. (If you already own a lot, you may not want to make any improvements to it until you get a construction loan. Having third parties work on the lot can raise mechanic’s lien issues that scare off potential lenders.)

During construction, banks charge interest only on the funds that have been dispersed, not the full loan amount. Your builder, not you, applies for funds at pre-determined stages of construction, typically when the contract is signed, the foundation is set, the home framed, and the home is completed. The first draw often covers closing costs and the purchase price of your lot. It sometimes includes house plan design fees, engineering costs, and permits as well. Before each payment is made, lenders want to see that suppliers have been paid (no liens have been attached to the property). They send an inspector to the house to report on the progress and the quality of work.

Before they make a loan, lenders will want to see a construction budget for the house along with your contract with the builder. The most thorough banks check the credit and references of your builder. They may want to see proof of insurance and insist that the builder be licensed in jurisdictions that require it. Other lenders may do only part of this due diligence.

That means you’ll need to take prospective lenders a comprehensive budget for the house. It needs to include the home design and material lists. It needs to include a landscape plan, if you plan to finance that too. Lenders will use your so-called “blue book” to do an appraisal of your unbuilt home. An appraiser will calculate the value of your home and compare it to the price of other homes in the neighborhood. Typically, a second appraisal is performed once the home is complete.

What if your home runs over budget? Most construction loans include a reserve of 5 to 10 percent. Also, if construction takes longer than expected – most loans are for about 12 months – you can usually extend the term of the loan, though it may not be easy. The lending arrangement creates plenty of incentive to exit the construction-loan period as quickly as possible. Lenders typically require a certificate of occupancy assuring the home meets fire, electrical, and safety codes before they will roll over the construction into permanent financing.

Construction loans can be structured with interest reserves to help with cash flow. At closing, funds can be allocated to an interest reserve that basically pays your interest cost. In this way, you may not have to pay anything until construction is complete.

Another financing approach is to get a bridge loan. This works if you have plenty of equity in your current home and plan to sell it. You can use the funds in the bridge loan to pay for construction while your new home is being built and you are waiting for your current one to sell. The risk to this approach is that you don’t know when your existing home will sell, and at what price.

If you have plenty of equity in your existing home, you may be able to finance construction of your house yourself. You could sell your existing home and renting a temporary one while you are waiting for your new one to be built. The downside is that you have to move twice. And if you intend to take out a mortgage on the new house, you lost an opportunity to lock in a low rate.

Another alternative, far less popular today than it used to be, would be to ask your builder to secure construction financing. That would certainly reduce the paperwork and inspection hassle of signing on the loan yourself. But the reality is that most builders these days are looking for their clients to get the loans. Besides, most homeowners can obtain a lower rate on the construction loan than their builder.

Whew! Now that you've made it through all of that important information, why not reward yourself by browsing through some New House Plansto get inspiration? If all this money talk renews your dedication to stay in budget, check out Affordable House Planstoo.